Have you ever felt your heart skip a beat when scanning your bank statement, only to stumble upon a puzzling charge labeled “WUVISAAFT”? You’re not alone in this financial mystery. This enigmatic string of letters has left countless Americans scratching their heads, wondering if they’ve fallen victim to some sneaky scam or if their account has been compromised. But fear not! Today, we’re going to embark on a thrilling journey to unveil the secrets behind this perplexing charge and equip you with the tools to become a true financial detective.

What is a WUVISAAFT Charge?

Before we dive into the nitty-gritty of solving this mystery, let’s first understand what exactly a WUVISAAFT charge is. In the world of banking, transactions often come with cryptic codes that are about as easy to decipher as ancient hieroglyphics.

These codes, known as merchant IDs or vendor codes, are used by financial institutions to streamline their transaction processing systems. Think of them as secret handshakes between banks and businesses – they know what they mean, but to us mere mortals, they might as well be written in Klingon.WUVISAAFT is one such code that’s been causing quite a stir among bank customers.

It’s important to note that this isn’t necessarily the name of a company you’ve done business with. Instead, it’s more likely a unique identifier assigned by your bank or a payment processor to represent a specific type of transaction or merchant. The mystery lies in figuring out what exactly this code stands for and why it’s showing up on your statement.

Steps to Identify the Source of the WUVISAAFT Charge

Scrutinize Your Bank Statement

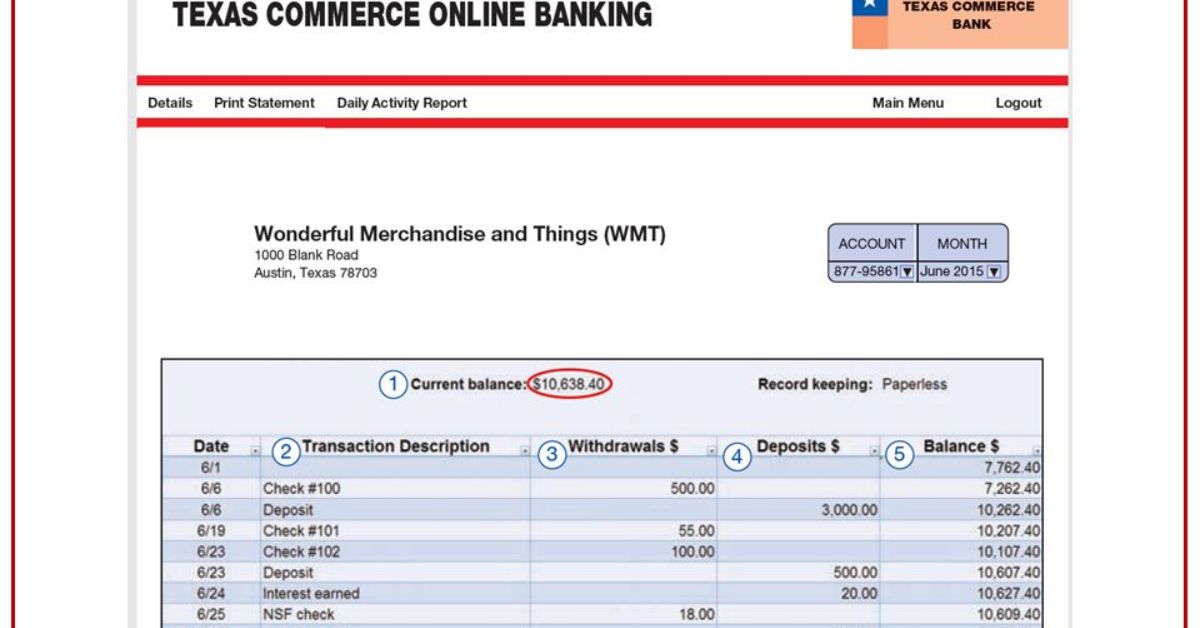

When you spot a WUVISAAFT charge on your statement, don’t panic! Take a deep breath and channel your inner Sherlock Holmes. The first step in our investigation is to scrutinize your bank statement with the precision of a forensic accountant.

Look beyond the mysterious code and pay attention to every detail surrounding the transaction. The date, the amount, and any additional description can be vital clues in solving this financial puzzle.For instance, let’s say you notice a $50 WUVISAAFT charge from last Tuesday. Try to recall what you were doing that day.

Did you grab lunch at that new hipster café downtown? Or perhaps you finally splurged on that vintage vinyl record you’ve been eyeing? Sometimes, the amount and date alone can jog your memory and help you trace the origin of the charge.

Leverage the Power of Your Bank’s Customer Service

If your own detective work hits a dead end, it’s time to call in the cavalry – your bank’s customer service. These unsung heroes of the financial world can be your greatest allies in decoding the WUVISAAFT mystery. Don’t be shy about picking up the phone and dialing that helpline number on the back of your card.

Remember, you’re not bothering them – it’s literally their job to help you with these matters! When you get a representative on the line, be prepared with your account details and the specific information about the WUVISAAFT charge. Ask them if they can provide more information about the merchant associated with this code.

Often, they have access to additional details that aren’t visible on your standard statement. And hey, if you have to navigate through a labyrinth of automated menus to reach a human, consider it practice for your future career as a secret agent.

Unveiling the Secrets of Online Banking

In this digital age, your online banking portal or mobile app can be a treasure trove of information. Many banks now offer detailed transaction summaries that go beyond what you see on your paper statement.

Log into your account and look for an option to view expanded transaction details. You might be surprised at the wealth of information hiding behind that simple WUVISAAFT code.Some digital banking platforms even allow you to click on individual transactions for more information.

This could reveal the full merchant name, location, or even a website associated with the charge. While you’re at it, consider setting up transaction alerts for future charges. This way, you’ll be notified immediately when a WUVISAAFT charge (or any other suspicious activity) occurs, allowing you to investigate in real-time.

Cautiously Consulting the Online Oracle

In our hyper-connected world, it’s tempting to immediately turn to Google when faced with a mystery like WUVISAAFT. While the internet can be a valuable resource, it’s important to tread carefully.

Not every website is trustworthy, and some might even be set up to take advantage of people searching for information about unfamiliar charges.If you decide to search online, stick to reputable financial forums or consumer protection websites.

Look for discussions where other people have encountered similar charges and found resolutions. But remember, don’t click on any suspicious links or provide personal information on unfamiliar sites. Your quest for knowledge shouldn’t come at the cost of your financial safety.

When in Doubt, Reach Out

If your investigation hits a wall, don’t suffer in silence. Unresolved mystery charges can eat away at your peace of mind and potentially hide more serious issues. It’s time to be proactive and reach out to your bank directly. Craft a clear, concise email detailing your concerns about the WUVISAAFT charge. Include all relevant information: the date, amount, and any steps you’ve already taken to identify the source.

Remember, persistence is key. If you don’t receive a satisfactory response, don’t be afraid to follow up. Your financial security is at stake, and you have every right to get answers. Keep a record of all your communications this paper trail can be invaluable if you need to escalate the issue later.

When WUVISAAFT Aligns with a Familiar Merchant

Sometimes, the solution to our WUVISAAFT mystery is hiding in plain sight. Many companies use abbreviations or codes in their billing that might not immediately ring a bell. For example, that WUVISAAFT charge might actually be from “World’s Unique Vintage Items Sold At Fantastic Prices” okay, I made that up, but you get the idea! The key is to think creatively about recent purchases and how they might show up on your statement

One effective strategy is to visit the websites of merchants you’ve recently patronized. Many companies have a section in their FAQs or customer service pages that explains how their charges appear on bank statements.

You might discover that WUVISAAFT is simply an abbreviation or code used by a familiar business. This kind of detective work can save you a lot of stress and potentially unnecessary disputes with your bank.

WUVISAAFT as a Merchant Abbreviation

In the world of transaction processing, space is often at a premium. This means that long, elaborate business names often get condensed into seemingly nonsensical codes or abbreviations. WUVISAAFT could very well be one of these shortened forms.

It might represent the first letters of each word in a company name, or it could be a combination of letters and numbers that make sense only to the payment processor.To crack this code, think about recent purchases you’ve made, especially from businesses with long or complex names.

Did you recently buy something from “Whimsical Unicorns & Vibrant Inventions Sold At Affordable Fantastic Treasures”? (Okay, I’m having too much fun making up these names, but you get the point!) If you suspect a particular merchant, try contacting their customer service. They should be able to confirm if WUVISAAFT is indeed their billing code.

WUVISAAFT as a Payment Processor

Sometimes, the WUVISAAFT mystery leads us not to a merchant, but to a payment processor. These are the behind-the-scenes players in the world of financial transactions – the companies that handle the nitty-gritty of moving money from your account to a merchant’s.

Many of these processors use their own codes, which can appear on your statement instead of the actual merchant name.If you’ve recently made an online purchase or used a digital wallet service, there’s a good chance WUVISAAFT could be related to the payment gateway rather than the merchant itself. Popular processors like PayPal, Stripe, or Square often use unique identifiers for transactions they handle. Check your email receipts from recent purchases they might mention the payment processor used, giving you a clue to solve the WUVISAAFT puzzle.

When WUVISAAFT Remains an Enigma

The Hallmark of Financial Security

Sometimes, despite our best efforts, the WUVISAAFT charge remains shrouded in mystery. This is where many people start to panic, imagining worst-case scenarios of fraud or identity theft. But hold your horses! While it’s good to be cautious, panicking rarely solves anything.

Instead, let’s approach this situation with the cool, calculated demeanor of a seasoned financial detective.Remember, unknown transactions don’t always mean fraudulent ones. Sometimes, our memory fails us, or a legitimate charge comes through under an unfamiliar name. The key is to remain vigilant without jumping to conclusions.

Think of this as an opportunity to flex your problem-solving muscles and take control of your financial narrative. After all, every great detective story needs a little mystery!

Time is of the Essence

When it comes to unrecognized transactions, time is not on your side. Most banks have specific timeframes for reporting and disputing charges, usually around 60 days from the transaction date.

This means that as soon as you spot that puzzling WUVISAAFT charge, the clock starts ticking. Procrastination is your wallet’s worst enemy in this situation.Set aside some time to deal with this issue promptly. Create a quick-action checklist: review your recent purchases, check for any automatic payments or subscriptions, and gather all relevant information about the charge.

The sooner you start your investigation, the fresher the transaction will be in your mind (and in your bank’s records). Plus, taking swift action shows your bank that you’re serious about your financial safety.

Fueling Your Investigation

To solve the WUVISAAFT mystery, you need to build a case that would make even the FBI jealous. Start by gathering every piece of information related to the charge. This includes the exact date, time, and amount of the transaction, any additional description on your statement, and a list of your activities around that time.

Create a financial dossier that includes:

- A copy of your bank statement highlighting the WUVISAAFT charge

- A list of all your recent purchases and their dates

- Any relevant receipts or confirmation emails

- Notes from your conversations with customer service representatives

- Screenshots of your online banking transaction details

This comprehensive collection of evidence will be invaluable if you need to dispute the charge or file a formal complaint. Plus, it demonstrates to your bank that you’re taking this matter seriously and have done your due diligence.

Contact Your Bank

If your personal investigation hits a dead end, it’s time to bring in the big guns – your bank’s fraud department. Don’t be intimidated; these folks deal with mysterious charges all day long. When you call, be prepared to navigate the customer service labyrinth. Have your account information ready and be clear about why you’re calling.

Here’s a script to help you get started:

“Hello, I’m calling about an unrecognized transaction on my account. There’s a charge labeled WUVISAAFT that I don’t recognize. I’ve already reviewed my recent purchases and can’t identify this charge. Can you please provide more information about this transaction or transfer me to someone who can help investigate this further?”

Remember, persistence is key. If the first representative can’t help, politely ask to speak with a supervisor or someone from the fraud department. Don’t hang up until you have a clear understanding of the next steps in resolving this issue.

Reporting for Duty

If all else fails and you’re confident that the WUVISAAFT charge is truly unauthorized, it’s time to file a formal dispute. This process signals to your bank that you’re serious about challenging the transaction and want it investigated thoroughly. Most banks have specific procedures for disputing charges, which may involve filling out a form or submitting a written statement.

When filing your dispute, be clear and concise. Provide all the evidence you’ve gathered and explain the steps you’ve already taken to identify the charge. Be sure to mention any conversations you’ve had with customer service representatives. Remember, you have rights as a consumer, including protection against fraudulent charges. Don’t be afraid to assert these rights if you believe you’ve been wrongly charged.

Conclusion

Congratulations, financial detective! You’ve now got the tools and knowledge to crack the WUVISAAFT code and take control of your bank statement. Remember, staying vigilant about your finances isn’t just about catching potential fraud – it’s about understanding where your money is going and ensuring that every transaction aligns with your financial goals.

The next time you spot a mysterious charge like WUVISAAFT, don’t let it ruffle your feathers. Approach it with the cool, calculated mindset of a seasoned investigator. Use the steps we’ve outlined: scrutinize your statement, leverage your bank’s resources, dive into online banking, and don’t hesitate to reach out for help when needed.

William, with 5 years of technology experience, brings expertise to our website. His profile reflects a commitment to excellence and innovation in his field.